Working with charities, we know how valuable Gift Aid can be to fundraising income streams, especially during a tough economic climate.

Here is a breakdown of the key Gift Aid submission information and resources available, to get the most out of your strategy, whatever your status.

Claiming Gift Aid as a charity?

Gift Aid is worth £1.3bn a year to the charity sector, but the Charity Finance Group estimated that more than £500m goes unclaimed each year.

This is a huge amount of unclaimed money, and with the current cost-of-living and energy crises, maximising income for charities is vital especially through the winter months.

UK charities can claim donations from up to 4 years after the end of the financial period you received it in. Either the end of the tax year (6th April – 5th April) for trusts, or your accounting period for CASCs, CIOs or limited companies.

We aren’t tax experts, so always check with your accountant or government tax advice.

Find out more

Government advice: Claiming Gift as a Charity or CASC

Looking to boost Gift Aid? Read our 5 top tips!

Claiming Gift Aid as a Taxpayer?

Did you know if you pay tax above the basic rate, you are entitled to claim the difference between the rate you pay and the basic rate on your donation, by submitting a tax self-assessment.

You can also claim tax relief on donations for both the past and present tax year. All you need to do is file your claim online before 31st January, in order to gain tax relief sooner.

Find out more

Claiming Gift Aid as a Company?

Companies too can benefit from Gift Aid, when making a donation. Instead of the charity making the claim for Gift Aid, the company offsets the 25% donation Gift Aid value against their profit, therefore delivering a reduction in the company’s Corporation Tax.

Boost your Gift Aid income

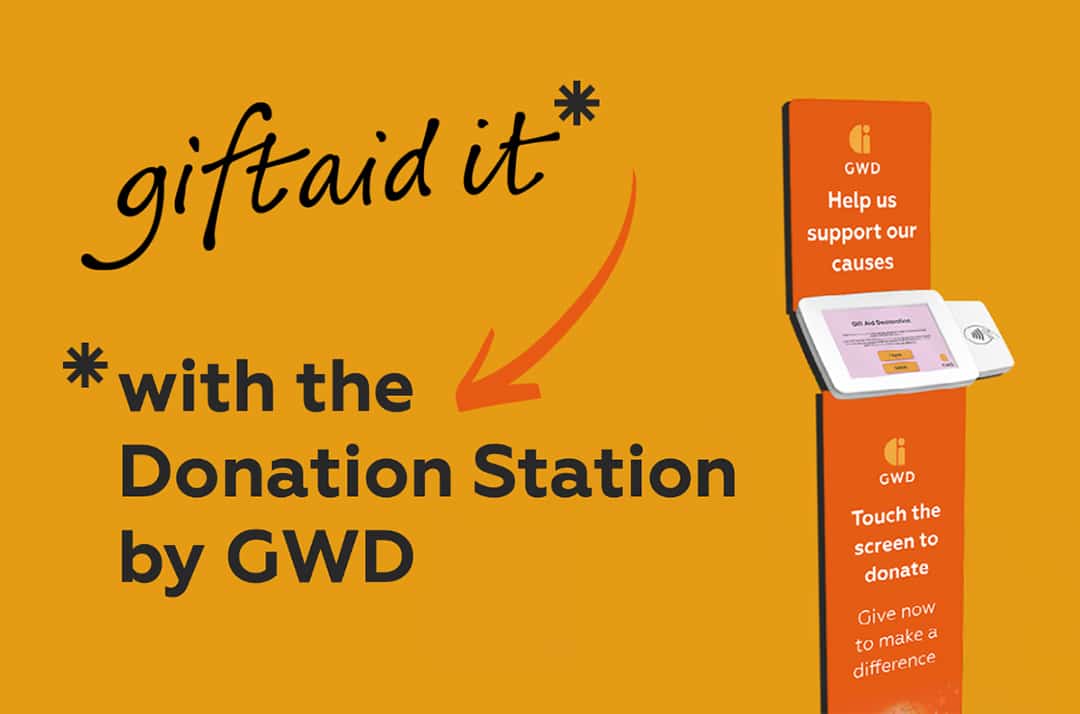

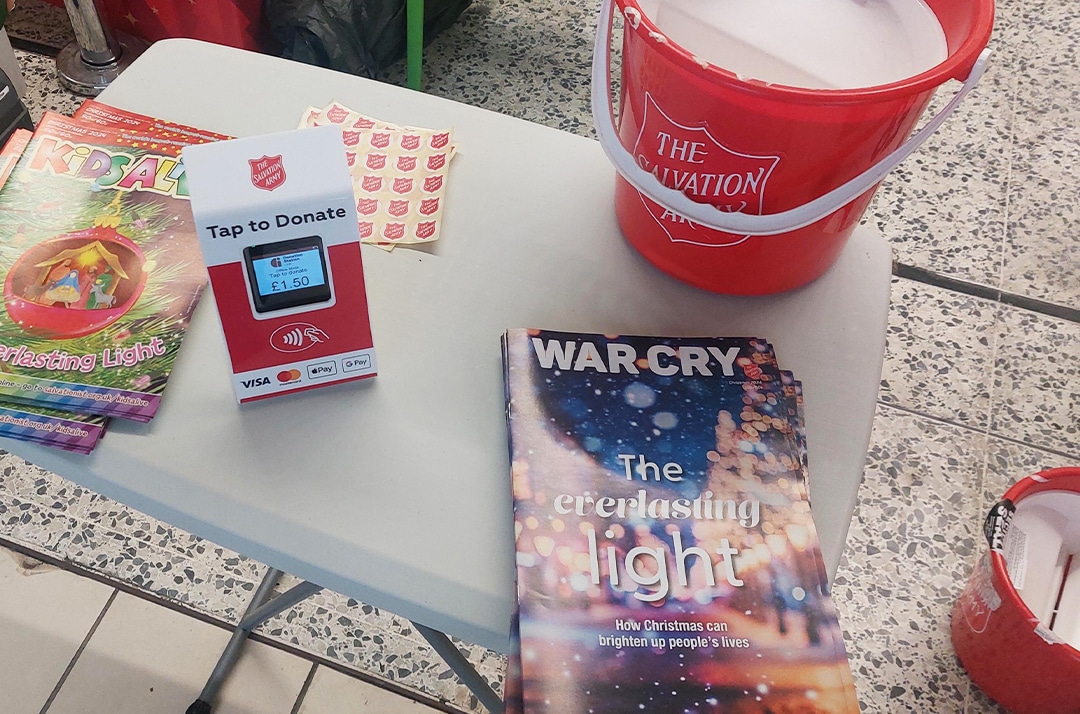

Using a contactless donation solution means, that with a Gift Aid integration, you can simply download your Gift Aid report and include this in your submission to HMRC.

Our customers have seen a huge boost in donations due to the devices feature:

An extra £72,539.45 was raised in 2022 through the use of Donation Station Gift Aid declarations, at no extra cost to the charity or the donor!

Find out more

Who are GWD?

We help socially-minded organisations transition to digital systems, building stronger relationships through impactful products and services.

Our experience goes back two decades, with a foundation building and providing critical digital services and products for the financial services and retail industries.

With a long-proven ability to handle challenging projects and a team of trusted experts, we work hard to solve problems and deliver change that helps others.

More from the Blog

Back

Back to top