For many people the introduction of SCA in September 2019 was only noticed when contactless transactions would start to mysteriously be declined, prompting the customer instead to make a chip and pin payment.

Due to rising fraud rates for primarily online transactions, the European Commission introduced the EU Payments Services Directive (PSD2) in January 2018. A key component of this was SCA, which lowered the amounts for transactions to be considered risky enough to require more authentication than just a card.

As of September 2019, the new regulations became enforced and a far greater number of transactions became subject to additional checks, affecting not only general commerce but also corporate fundraising efforts. But what does this mean for unattended contactless payments? Surely low value transactions would be exempt?

Actually no. Low value transactions are less strictly regulated, but once contactless payments either exceed €100 in sequential uses, or the number of individual uses reaches 5, the next transaction will be subject to SCA, which means in most cases, will require a chip and pin transaction instead.

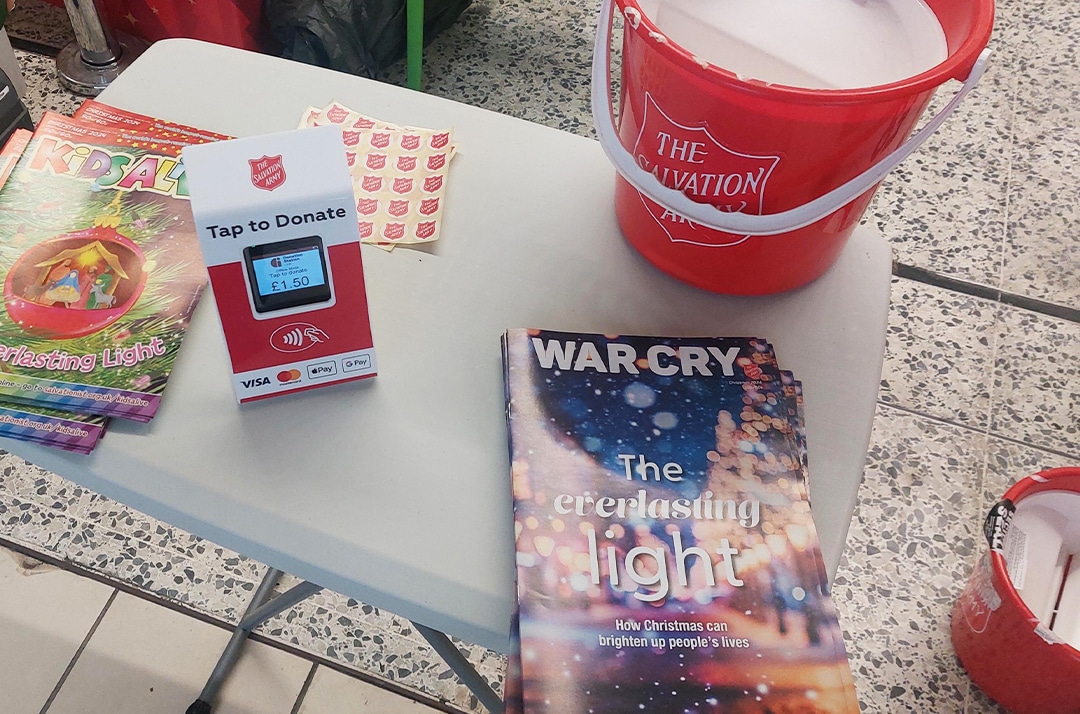

This means that to achieve the best possible coverage for unattended cashless payments, you should look to add chip and pin to your payment options, utilising modern contactless payment devices that include both technologies. By covering both bases, in the event that your customer hits the limit for unsecured contactless transactions, either in amount or number of uses, you’ll still be able to accept their payment.

Think cashless, not just contactless, and you won’t lose out to SCA. Explore how contactless fundraising adapts to new financial security measures and the benefits of corporate partnerships.

Who are GWD?

We help socially-minded organisations transition to digital systems, building stronger relationships through impactful products and services.

Our experience goes back two decades, with a foundation building and providing critical digital services and products for the financial services and retail industries.

With a long-proven ability to handle challenging projects and a team of trusted experts, we work hard to solve problems and deliver change that helps others.